What is a Family Office?

A Family office is a full-service, private, financial institution that offer a holistic resolution for preserving, managing, and growing the wealth of ultra-high-net-worth families or individuals.

High-net worth families are mainly focused on “building” their successful businesses to grow their wealth. In doing so, there is hardly any time left to take care of the increasingly complex financial needs that automatically arise with running a successful business or company. This is where the role of a single, or multi-family office comes in.

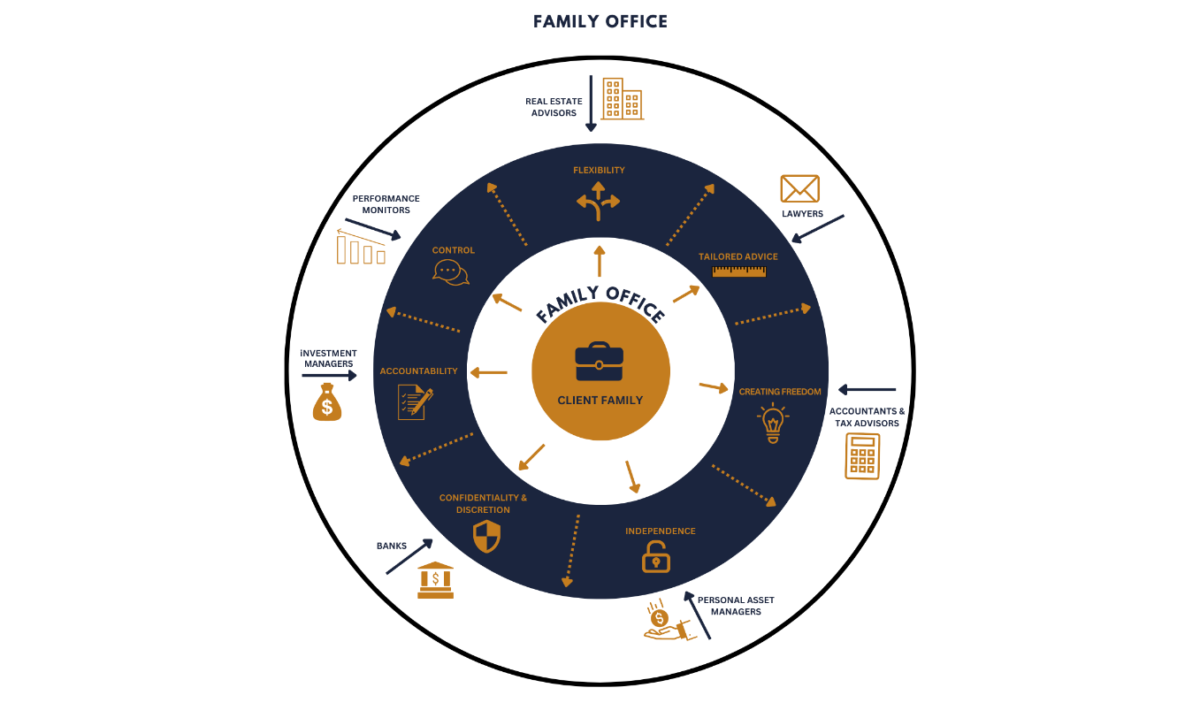

Family Office acts as a ‘One point of contact’ for all services related to wealth preservation, growth and transfer. They present a well-coordinated, collaborative effort by a team of professionals that provide integrated planning, advice, and resources needed in legal, insurance, investment, estate, business, and tax disciplines.

Single-Family and Multi-Family Offices

Modern Family offices are of two types-

1. Single-Family Offices, that serve only one ultra-affluent family and

2. Multi-Family Offices (MFOs) that serve multiple families, or individuals. Therefore, by definition, the MFOs are closer to private wealth management firms in their functioning.

Naturally, since a Single-Family office exist to serve only one High Net-worth family, it is much more expensive than an MFO. These offices are mainly established by someone in the family, to manage the family’s wealth and assets. Since, all the experts that work in a single-family office are employed by the family, there is no conflict of interest. The SFO s exist solely to serve the interest of that family. But the biggest challenge in a Single-Family Office is getting access to the right set of professionals with relevant expertise and retaining them. Most experts do not want to be confined with one single family, and it gets difficult to ensure continuity.

A Multi-family office, or an MFO, also offer the same services as a Single-Family Office, but at a lower cost, since they cater to multiple families. It gives the families access to highly experienced subject matter experts, and professionals, and usually charge a percentage, for their services.

With the rise of India’s Ultra-High Net Worth population, family offices, be it as SFO, or MFO, will play a bigger, and a more significant role in protecting, managing, and growing a family’s wealth across generations.

Why do you need a Family Office?

It is not enough for a family just to have savings and investments. There needs to be a strong support model for the family’s money matters, so that the collective wealth can be sustained for a long term for generations. This can be best done with efficient support system like a Family Office.

Therefore, the growing need of a Family office in India stems not from the need to preserve wealth, but more for handling all the complexities that comes with preserving, maintaining, growing and transferring wealth and investments, as well as execution of will, tax complexities, etc.

How do you know you need a Family Office?

Eric Becker , the Co-founder of Cresset Family Office, has a few helpful points that can help anyone identify whether at all they need a family office. He asks everyone who is still indecisive, to ask themselves five questions, and if the answer to those is yes, then you will likely need a family office.

a. Are you anticipating any substantial liquidity event in the next 2-5 years?

b. Have your finances become complex that you no longer have time or skill to manage it?

c. Do you have doubts that your children or grandchildren are able, and ready to manage the family’s wealth for the long-term?

d. Do you have doubts about whether your financial advisor truly has your best interests at heart?

e. Are you confident about your wealth transfer strategy and estate plan?

At the end of the day, it all comes down to how much wealth you have, and how complex your financial situation is. Maybe you have a complex wealth structure, too many assets, shares, multiple businesses, and want to make sure your family is taken care of financially for multiple generations.

The Many Disciplines and benefits of a Family Office

Family offices single-handedly ensure that all family’s assets are invested properly, and protected, keeping in mind the over all financial well-being of the members. Not just investments, a family office also takes care of estate planning, taxation, legal issues, cash streams, will planning, etc. Not just this, but in some cases, family offices also manage travel logistics, family education planning, philanthropy, as well as any lifestyle management.

One Platform, Multiple Investments:

Family Offices offer a wide variety of investment solutions to help families achieve their goals and offer a consolidated view to track them easily.

Financial life & beyond:

They go beyond investments, including Loan Financing, Estate Planning, Wills, Trusts, Tax, and Legal advice.

Dedicated Family Office for you: Family Offices are focused on helping you build, preserve, and manage wealth through all life stages

Conclusion

With the rise of the Uber-Rich, more families have realized that the importance should not only lie in the functioning of the core business. But equally significant is knowing how to efficiently manage, invest, and grow the profit from their business to continue the legacy.

Over the last few years, Family Offices have evolved to offer everything a wealthy family needs. From the expected, such as investment management; to the more sophisticated, such as estate & succession planning, philanthropy, as well as lifestyle enhancement services.